Culture

Sign Up To The Esquire Junk Mail Newsletter

The only entertainment digest you need

Introducing… the Junk Mail, About Time and Esquire Shops Newsletters

Advertisement - Continue Reading Below

The Big Interview

Denis Villeneuve on the Five Films That Inspired 'Dune: Part Two'

Advertisement - Continue Reading Below

Cosmo Jarvis Breaks Down the ‘Shōgun’ Finale

The Biggest TV Shows of 2024

Why ‘Fallout’ Beats ‘The Last of Us’

Netflix's ‘Baby Reindeer’: The Ending Explained

Q&A

George Clooney Dives Into ‘The Boys on the Boat’

Austin Butler Prepares for Takeoff

Author David Nicholls on One Day's Second Shot

John Wilson on the End of 'How To'

Advertisement - Continue Reading Below

Tabitha Lasley: What It Felt Like for a Girl

How to Read the 'Ripley' Novel Series in Order

How to Read the '3 Body Problem' Novels in Order

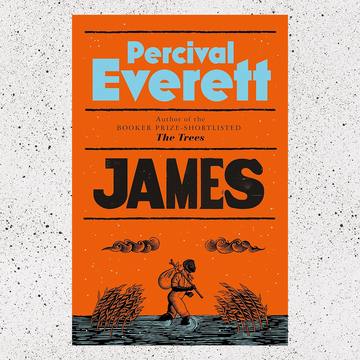

Percival Everett's New Novel Is a Modern Classic

latest

Travis Scott's First Original Jordan is Incoming

29 of the Best Tequilas To Drink in 2024

The Best Menswear in the World (This Week)

Cannes 2024: Movie Previews

The Best Movies of 2024

The 40 Best Watches a Man Can Buy In 2024

Future is Dressed for the (Wild, Wild) West

‘Challengers’: That Climactic Ending, Explained

Thibaud Crivelli Bottles His Life Experiences

Duke and Dexter's New Apparel is Fast and Furious

Justin Marks, Rachel Kondo Made ‘Shōgun’ a Classic